Press Releases

Graves Fights Back as Industry-Prejudice Threatens CARES Act Relief for Louisiana’s Energy Sector

Washington, DC,

May 13, 2020

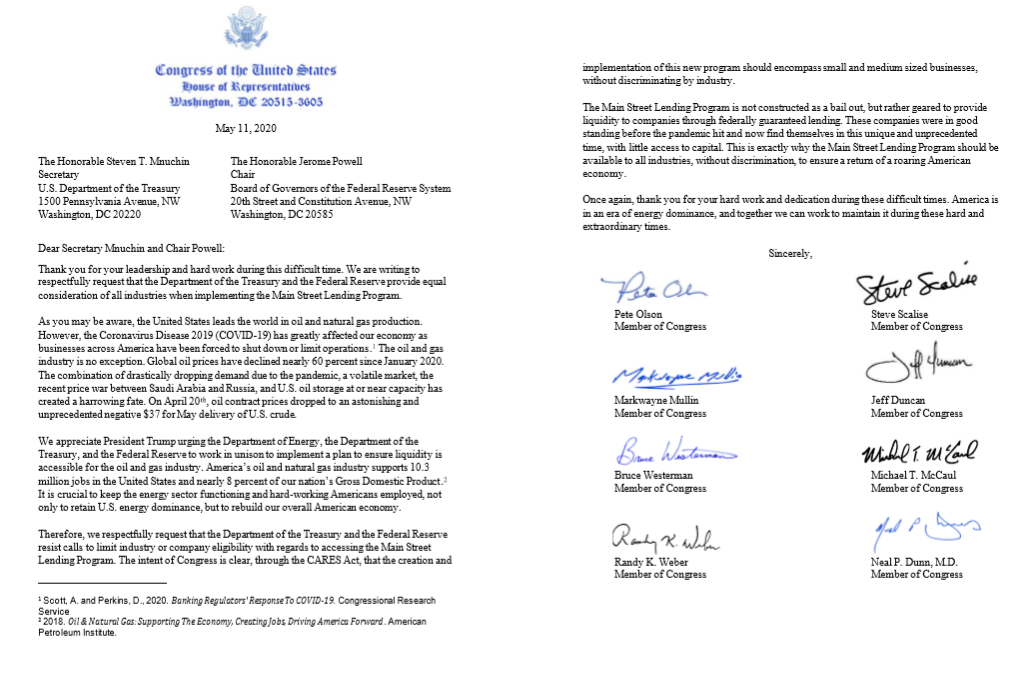

U.S. Congressman Garret Graves (South Louisiana) called upon the Department of Treasury and the Federal Reserve to remain committed to oil and gas businesses being considered applicable under the new Main Street Lending Program. Graves joined 59 colleagues in sending the letter in response to growing opposition for all industries to be provided equal consideration with the program even though COVID-19 has impacted businesses across the country. The full text of the letter can be found here or below: Dear Secretary Mnuchin and Chair Powell: Thank you for your leadership and hard work during this difficult time. We are writing to respectfully request that the Department of the Treasury and the Federal Reserve provide equal consideration of all industries when implementing the Main Street Lending Program. As you may be aware, the United States leads the world in oil and natural gas production. However, the Coronavirus Disease 2019 (COVID-19) has greatly affected our economy as businesses across America have been forced to shut down or limit operations. The oil and gas industry is no exception. Global oil prices have declined nearly 60 percent since January 2020. The combination of drastically dropping demand due to the pandemic, a volatile market, the recent price war between Saudi Arabia and Russia, and U.S. oil storage at or near capacity has created a harrowing fate. On April 20th, oil contract prices dropped to an astonishing and unprecedented negative $37 for May delivery of U.S. crude. We appreciate President Trump urging the Department of Energy, the Department of the Treasury, and the Federal Reserve to work in unison to implement a plan to ensure liquidity is accessible for the oil and gas industry. America's oil and natural gas industry supports 10.3 million jobs in the United States and nearly 8 percent of our nation's Gross Domestic Product. It is crucial to keep the energy sector functioning and hard-working Americans employed, not only to retain U.S. energy dominance, but to rebuild our overall American economy. Therefore, we respectfully request that the Department of the Treasury and the Federal Reserve resist calls to limit industry or company eligibility with regards to accessing the Main Street Lending Program. The intent of Congress is clear, through the CARES Act, that the creation and implementation of this new program should encompass small and medium sized businesses, without discriminating by industry. The Main Street Lending Program is not constructed as a bail out, but rather geared to provide liquidity to companies through federally guaranteed lending. These companies were in good standing before the pandemic hit and now find themselves in this unique and unprecedented time, with little access to capital. This is exactly why the Main Street Lending Program should be available to all industries, without discrimination, to ensure a return of a roaring American economy. Once again, thank you for your hard work and dedication during these difficult times. America is in an era of energy dominance, and together we can work to maintain it during these hard and extraordinary times. Sincerely, Previously, Graves issued a statement regarding the U.S. Department of Energy's announced crude oil contracts to help store 23,000,000 barrels of U.S. produced crude oil in the Nation's Strategic Petroleum Reserve (SPR), and a statement regarding the historic oil global price war deal reached on April 12, 2020. Graves joined his colleagues calling upon the Crown Prince of Saudi Arabia Mohammad bin Salman to take immediate action in bringing stability to global crude oil markets. This letter followed after Graves had called upon the U.S. Department of Energy (DOE) to fill the Strategic Petroleum Reserve (SPR) to absorb the supply glut and to counter the economic warfare threats posed by Saudi Arabia, Russia and OPEC nations. Graves later applauded DOE for their decision to fill the SPR. About the Main Street Lending Program: The Main Street Lending Program (Program) was established to support lending to small and medium-sized businesses that were in sound financial condition before the onset of the COVID-19 pandemic. The Program will operate through three facilities: the Main Street New Loan Facility (MSNLF), the Main Street Priority Loan Facility (MSPLF), and the Main Street Expanded Loan Facility (MSELF). Term sheets for each facility and Frequently Asked Questions (FAQs) providing more information regarding eligibility and conditions can be found here. |